Your Financial Roadmap: Addressing financial planning FAQs and Vital Insights

Your financial planning questions answered, from retirement planning to offshore investments.

As advisers, our role is to guide, advise, plan, report, and look for opportunities so that the journey or path our clients are on is the right one. Along this road, we encounter recurring themes and frequently asked questions (FAQs). Below, we address some of the common ones.

How much do I need for retirement, and how much should I save?

My initial response is to save as much as possible, but realistically, one should aim for around 20 times their final annual salary. For example, if someone needs R50,000 per month for their first year of retirement, their annual income of R600,000 should be multiplied by 20 to reach R12,000,000. Calculating backward, this means a 5% withdrawal rate on the R12 million to provide R50,000 per month. A 5% withdrawal rate allows capital to grow, ensuring a sustainable income throughout retirement. The amount to save depends largely on your start date. Starting early is better, benefiting from the power of compounding. A general rule of thumb is to invest no less than 15% of your income.

How much life cover do I need?

The amount of life cover required depends on your family's needs, assets, and liabilities. Generally, you should aim to leave enough capital to replace around 70% of your current income for your family and to clear major debts like mortgage bonds. Family circumstances vary; you might have young children who need education funds, or your family might need income for a shorter timeframe if they are older. Life cover provides immediate liquidity to your estate, which is crucial, especially when there are assets like property that can take time to liquidate, divide among heirs, or sell.

Additionally, protecting your income and earning ability is vital. Income protection on temporary or permanent disability is often overlooked, and severe illness cover can provide financial security in cases like cancer or stroke. While insurance is sometimes perceived as a grudge payment, when structured correctly with your Financial Advisor, and with some companies offering discounts for loyalty or good health, these essential needs can be covered.

What percentage of my portfolio should be offshore?

The ideal offshore allocation varies depending on your risk profile and tolerance. Despite the noise around BRICS, South Africa represents less than 1% of the global economy. Thus, including offshore exposure in your portfolio makes sense. It's not just about hedging against currency fluctuations but also about investing in asset classes with global exposure. Understanding the underlying asset classes and geographies in your investments is crucial.

Recent changes in Regulation 28 allow retirement funds to increase their offshore holdings from 30% to 45%, giving fund managers the authority to make this decision. However, too much offshore allocation can add volatility to your portfolio. Investors seeking income may require more yield and capital stability. Additionally, interest rates and yields in South Africa are often more attractive than those offshore. The mantra of "income local and growth global" is often advocated. For older retired clients, an offshore exposure of 25% to 40% is generally recommended, while younger individuals aiming to grow their wealth can consider an allocation of 50% to 70%.

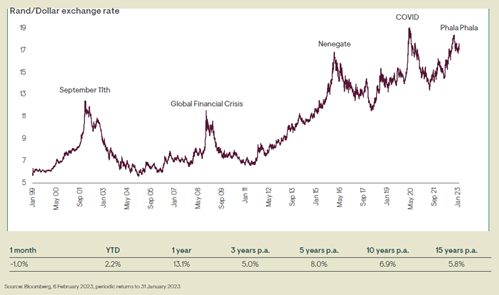

Addressing Rand depreciation and timing the currency

Although there's a common perception that Rand depreciation is a one-way trend, Graph 1 illustrates the consistent depreciation of the Rand against major currencies such as the Dollar. It displays notable fluctuations in depreciation and appreciation. Nonetheless, there are periods of substantial depreciation, occasionally reaching approximately 20%. However the long-term average hovers closer to around 6% per annum

Graph 1: The rand depreciates over the long term and is vulnerable to risk aversion.

Source: Ninety One Asset Management

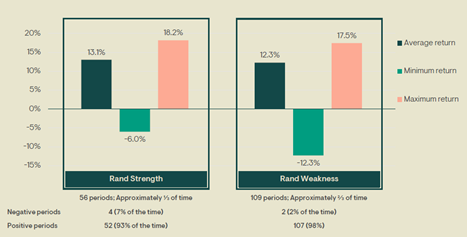

The bar charts below, highlight the challenges of timing currency movements when investing offshore, using a global equity fund as an example. The difference in average return is less than 1%. The answer to currency-related concerns is to invest offshore according to your asset allocation requirements and not overly stress about timing.

Illustration 2: Do I take my money offshore now?

For an investment in Global Franchise

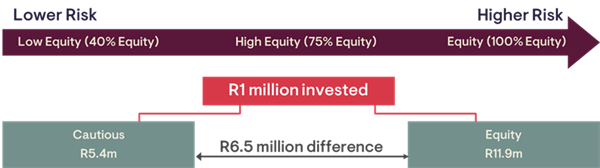

Investment time horizon and risk

South Africa's increasing life expectancy prompts consideration of long-term investment horizons. Many investors tend to underestimate their time horizon, leading to excessive risk aversion in what should be long-term growth investments. Consider the scenario of an investor who underestimates their time horizon and opts for a cautious fund instead of an equity fund. An illustrative chart reveals the impact, where a R1 million investment in the average multi-asset low equity fund over twenty years would return R5.6 million at the end of June 2023. In contrast, the same R1 million invested in the average South African equity fund would yield R11.9 million. The impact is even more pronounced when the same allocation is made to a fixed-income fund with lower risk.

"With time, certainty increases. Over shorter periods, equity investors face higher risk, but as the investment horizon lengthens, the risk of a negative return diminishes, enhancing the investment outcome."

Source: Ninety One Asset Management

In conclusion, while investors may have similar questions, individual circumstances differ. The adage of "horses for courses" applies. Don't hesitate to consult your Financial Advisor. While certain rules govern the game, each person's unique circumstances require personalised guidance on their financial journey.